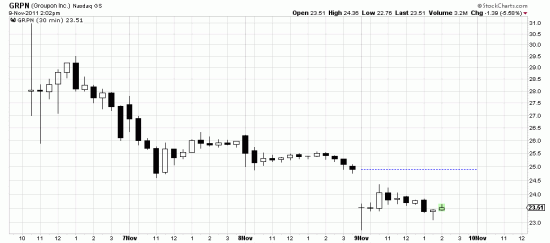

We rarely comment on I.P.O.s. This is because we understand the essential mechanics of these deals. They exist to transfer money from the public to entrepreneurs and Wall Street underwriters. Viz, Groupon, above. These deals are always priced at what the market will bear — meaning overpriced most of the time. Back in the 90s in the tulipomania I.P.O.s shot up like rockets on offereing day. We later learned it was because of “laddering”. That is, the sponsors sold pre offering shares to their fund and hedge fund buddies with the understanding that the buddies would buy more shares in the after market — rocket fuel boosters.

We rarely comment on I.P.O.s. This is because we understand the essential mechanics of these deals. They exist to transfer money from the public to entrepreneurs and Wall Street underwriters. Viz, Groupon, above. These deals are always priced at what the market will bear — meaning overpriced most of the time. Back in the 90s in the tulipomania I.P.O.s shot up like rockets on offereing day. We later learned it was because of “laddering”. That is, the sponsors sold pre offering shares to their fund and hedge fund buddies with the understanding that the buddies would buy more shares in the after market — rocket fuel boosters.

Listen, honest reader, there is no way you can know all the crooked tricks of Wall Street.

Of course there are Microsoft and Google — and others. Exceptions that prove the rule. If you are unusually canny or perceptive maybe you can separate the wheat from the chaff. By and large we don’t even try. We regard these situations as either crap games or roulette wheels. If you have the skills you can play the game. Just be aware that it is three card monte. You are enriching the CEO of the issue and the Wall Street banker. We prefer to wait until we see some chart history. As for Groupon it was obvious long before it went public that it was a con.