http://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=9&dy=0&id=p15218233755&a=236108789

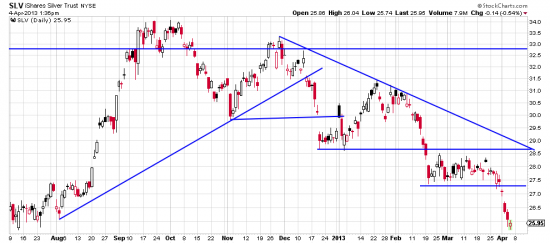

When silver broke we passed on a short trade because we thought a large profit unlikely. This is only the 7,198th time we have had to relearn this lesson. If the chart says short it, shut up and short it. So we should be adding on here instead of shorting it which we did.

Silver caught the Transportations south.

http://stockcharts.com/h-sc/ui?s=IYT&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=294628186

Now let’s get technical. A trendline break is always serious. Conservative investors (or traders) wait for confirmation, that is price 3% beneath the trendline, which is 105.66 in this case. The other lesson we have learned 3,124 times is to take the conservative trade. Ge-ron-i-mooo! Jump and pull the rip cord. Don’t do this at home. So we shorted the IYT too. Later we will examine the implications of this apparent (to be confirmed break in the short term trendlines in the Transportations.