http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=0&mn=5&dy=0&id=p06327879895&a=223624367

If you live for excitement last week got your blood pumping. If you are amused by lying and cheating you have to be in hysterics at the CME’s bald statement that increases in silver margin had nothing to do with the crash in silver. And you have to wonder why the CFTC doesn’t investigate conflicts of interest there. For instance, how many members were short silver and knew about the coming increase in margins? Bunker Hunt is rolling over in his grave because that’s how they rolled him. Allowing the casino operator to have bets on the table would not be permitted in Monte Carlo but here the casino operators, with the collusion of the politicians make the rules. How to lie cheat and steal and enrich yourself.

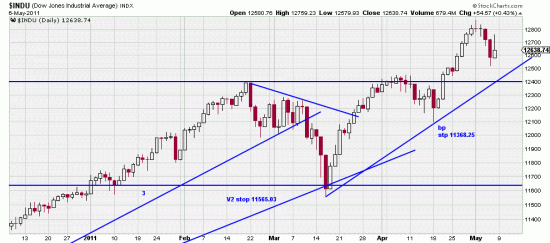

Meanwhile back at the Dow, prices have broken out of the (presumed) Kilroy (reverse H&S) pattern, and last week’s activity is like a standard return to the breakout line. So nothing of moment there, and we have shown the new Basing Point and stop of 11368.25.

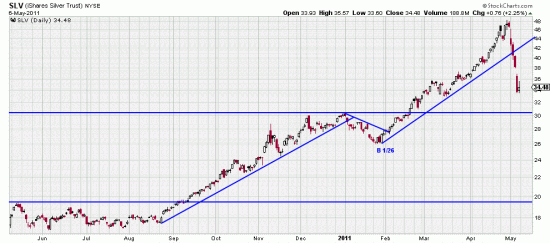

And Silver. What is there to say about silver that we haven’t already said? And all of it prescient. Waves, stops and danger. Which brings up the use of this letter by readers. If you read it for amusement (and it is amusing) (isn’t it) and don’t take action (like setting stops) you missed the point. You are supposed to use this letter to make money in the markets and to protect your capital assets. Otherwise we despair. And weep crocodile tears. For our very raison d’etre is thrown into question. How would you feel if your raison d’etre were thrown into question?

And chart analysts accept what is and analyze it — meaning we are now looking for our reentry point. That means the completion of the dump (which is still going on) bump-dump-surge pattern. Don’t try to catch bottom in the silver plunge unless you are feeling lucky. You could catch a falling knife instead. (See 10 Lessons: Bottoms)

And chart analysts accept what is and analyze it — meaning we are now looking for our reentry point. That means the completion of the dump (which is still going on) bump-dump-surge pattern. Don’t try to catch bottom in the silver plunge unless you are feeling lucky. You could catch a falling knife instead. (See 10 Lessons: Bottoms)

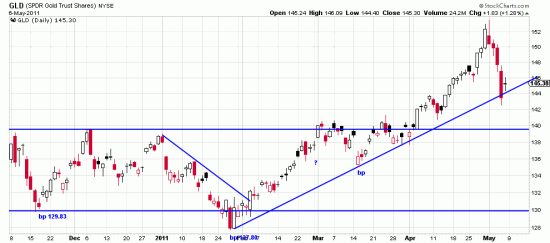

Friday may have been the beginning of the bump in gold, which surprisingly hasn’t (yet) been hammered like silver. (Could happen)

Friday may have been the beginning of the bump in gold, which surprisingly hasn’t (yet) been hammered like silver. (Could happen)

The wave low Basing Point here is April 1, 137.72, stop 130.83.

We always report our personal trades, and we made savvy exits from these markets and saved equity grief by doing so. Readers, of course can follow our trades, which have proved quite adroit. But the true purpose of our analysis is to reap long term profits, as here in gold our systems didn’t even blink at this downdraft, and we, personally now have to accomplish reentry.

The markets continue psychoid. The causes are: Flash and high frequency trading, extreme anxiety amongst the professional managers for their jobs (you thought they were worried about making money for you account? Duh.) Professional anxiety about whether the government will be able to change the game and affect their ability to enrich themselves by maintaining opaque unregulated markets–and a host of other stuff we don’t want to think about right now.

Ruler clutched firmly between our teeth, and mechanical pencil in hand we soldier on. Simple chart analysis seems to permit us to sail between these Scyllas and Charybdises. (How many of your other investment letter writers can even spell Charybdis?)