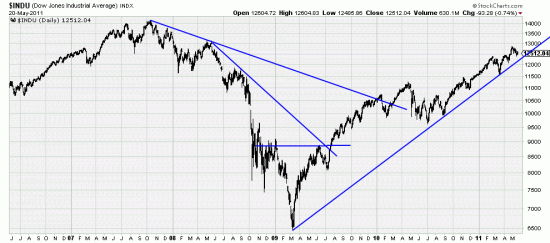

Five years of the Dow. And everyone and his dog (of the Dow) is anxiously asking what’s next (?). Well, what is next? First of all a trend this powerful and long is not reversed by a few talking heads and pundits carrying end of the world as we know it signs. As an example of how wrong they can be, is the rapture occurring in your neighborhood today? There. Of course that guy with the sign will be right one of these days. But not today.

Five years of the Dow. And everyone and his dog (of the Dow) is anxiously asking what’s next (?). Well, what is next? First of all a trend this powerful and long is not reversed by a few talking heads and pundits carrying end of the world as we know it signs. As an example of how wrong they can be, is the rapture occurring in your neighborhood today? There. Of course that guy with the sign will be right one of these days. But not today.

But there are interesting things occurring on the long term chart. Namely it looks like prices are flirting with the tdrend line from March 09. You want to know what happens when the Mississippi floods? That’s what happens when a trendline of this length is broken. And, while the bull trend pattern is intact it has a sideways momentum to it. A broken trendline does not always presage a bear market. We could get a mule (or sideways) market. But if you look at what’s happening here you could see a top pattern developing.

Now, as we repeatedly warn, this is speculation, and speculation is potentially dangerous, because it leads you to rash conclusions and to rash action. However we don’t think it would be rash to be doing some hedging.

But in the end you have to wait for the Basing Point stops to be taken out. That’s what patience (and discipline) are about. If you let your practice be run by what you think is going to happen, instead of what is actually happening you will wind up one unhappy camper. And as all old Scouts know, nothing is more tedious than a cold wet hungry whining camper.

Please let us know if the world is ending in your neck of the woods. We certainly will not schedule any campouts there.