Barron’s is touting longs. Joe Schmoo is getting short. Dow Theory guys are buying. Short interest is at historic high. (A word about “negative” indicators here. Some bulls take huge short interest as a contrarian signal that the crowd has to be wrong and so big short interest means a bull run is about to start. Of course there is always that 10% of the time when the crowd does turn out to be right and you get your head torn off for fading it.) The din of competing opinions is cacophonous. Fortunately we observe these opinions (because that is what they are) and throw them in the trash.

Barron’s is touting longs. Joe Schmoo is getting short. Dow Theory guys are buying. Short interest is at historic high. (A word about “negative” indicators here. Some bulls take huge short interest as a contrarian signal that the crowd has to be wrong and so big short interest means a bull run is about to start. Of course there is always that 10% of the time when the crowd does turn out to be right and you get your head torn off for fading it.) The din of competing opinions is cacophonous. Fortunately we observe these opinions (because that is what they are) and throw them in the trash.

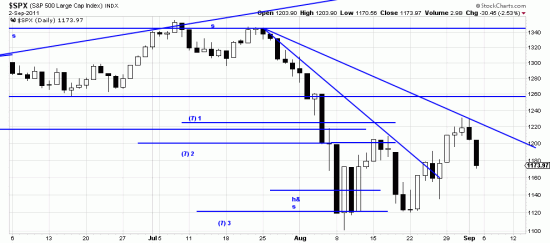

Barron’s did suggest a good hedging mechanism: late year calls on VIX, long a December 35 call and short a VIX December 40 call. We mention it with some trepidation — not wanting to lead readers into water over their heads. If it looks like deep water to you but you want to do something consult you local options expert. Of course the reverse ETFs are good for shorting or hedging. We see no rationale for long positions in a market with this chart, especially since the last upwave just broke.

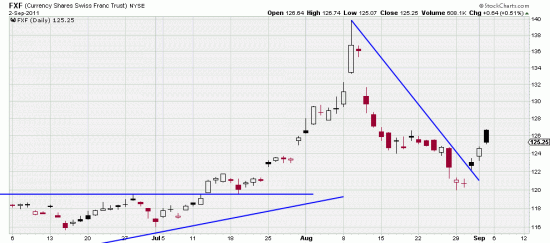

But we could see a long position in the FXF Swiss franc.:

Gaps, broken trend line, island reversal. Good signs.

Gaps, broken trend line, island reversal. Good signs.

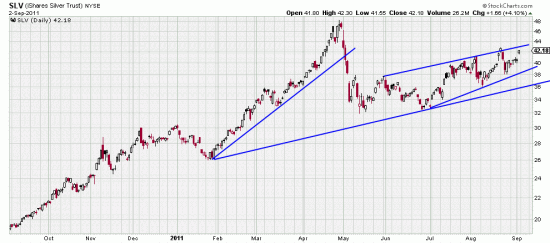

As we noted earlier we bought gold. But silver looks iffy. It might be in a rising wedge.

If so a bearish outlook.

If so a bearish outlook.

Enjoy Labor Day. With it comes some welcome relief to the depressing circus in Washington: Are you ready for some football?!!

USD proposes a move over next days.

30y T-Bond (ZB) at 140/142 resistance.

Sure all the rest including gold ‘may or may not’. From my experiance it meant often that the correction (gold, CHF sideways, spx, crude, copper up side) was not over yet.

Also, Dr. Ben may get his helicopter ready once more. My strategy, keeping the powder dry, at least some days more.

Alain