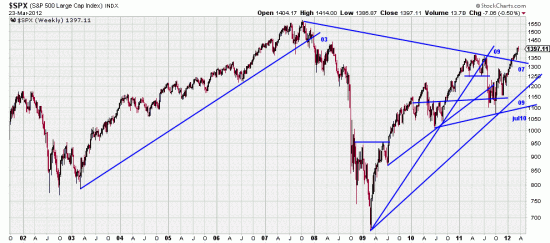

Note the new long term trendlines from Jul 10 and Mar 09.

Note the new long term trendlines from Jul 10 and Mar 09.

Or looked at another way, how many analysts fit into a thimble? Sunday’s Times features an article by an economist we repsect, Paul Lim who noodles with the idea of bull market lengths and where we are at present in the average bull market picture. Well, Lim can dance on the head of a pin. He says that the average bull market is somewhat less than 4 years — so counting from March 09 the present bull is (this month) 3 years old. Worry, worry.

Well, this is not Lake Wobegon where all the children are above average. And noodling with these things anyway is a pursuit we don’t take seriously. Once again — it detracts from the exact context, the exact and precise nature of what is happening in the market right this minute. The Baba Ram Dass market view. This is not to totally disparge noodling. And Lim is not far off in his noodling. The average Dow Theory bull signal lasts about 2.81 years. The average Magee Basing Points long trade lasts 2.88 years. But (showing how even above average kids can be misleading) one Dow Theory trade lasted 2891 days, just as one Magee trade lasted 3500 days.

Analysts, as they crawl out of the thimble in Lim’s article are worried about whether we are in the 4th year or whether a new bull market started in October. As we said, we don’t even begin to think that way. From a wave analysis point of view the Mar 09 bull market ended in July of 11 and a new wave started in October. We subjected the first wave up out of that debacle and produced eye-popping forecasts using the rule of seven, as well as extensive point and figure analyses forecasting similar targets.

That ought to resolve that question.

Unfortunately it does not solve the question of the thin ice we are skating on.

We are now going on 69 days of inch-worm progress in prices without a downdraft of any significance. Traders are buying volatility like crazy — according to Larry McMillain (optionstrategist.com) one of our most respected colleagues they are naively doing so — and we agree (having dabbled in it once or twice ourselves.) The $vix is quite low, but that’s like the kids in Lake Wobegone. It only matters when it matters. Taking a wild flyer we are going to hazard a guess that this trend is going to continue for awhile before the bears successfully attack it. When prices clear the high made March 16 we will be adding to our positions. If there is a correction before that happens we will be adding on the alpha-beta-gamma-zeta pattern.