Also low flying pundit b.s.

Also low flying pundit b.s.

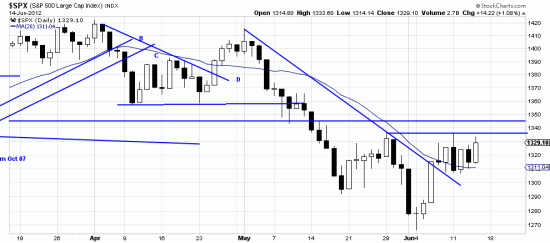

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=3&dy=0&id=p88572661534&a=214966864

We appear to be experiencing the same bunge market we enjoyed in April. Or, if it’s up let’s sell it hard, if it’s down buy big.

And every pundit in the world is breathlessly watching to see if the present formation turns into a reverse (Kilroy) head and shoulders. It’s not (no right shoulder) (yet), but it is a bottom formation. Its measuring implications would take price to about 1412. This a favorable chart and ought to presage a good bull wave.

But let’s place it in the economic and technical context — economically the refusal of the Congress to take action on jobs can do nothing but exacerbate unemployment, and the refusal of the Greeks to collect taxes and the reluctance of the Germans to be good sports about it hangs over the market like an approaching tornado. Volatility traders are having a field day trading the news. Today on central bank rumors the SPX moved 12 points up in eight minutes where it was promptly faded by traders and driven back down to where it came from.

Trends tend to continue, so this will continue for awhile, and then we will get a wave up. If the upwave catches the traders short there will be lots of fun — explosive moves and trader blood in the street.

Oh –and coronal mass ejections? Like monkeys throwing their feces at onlookers the sun is hurling matter at us just for fun. Sometimes these events seem to spook the market, sometimes not. Maybe it will affect the Greek election.