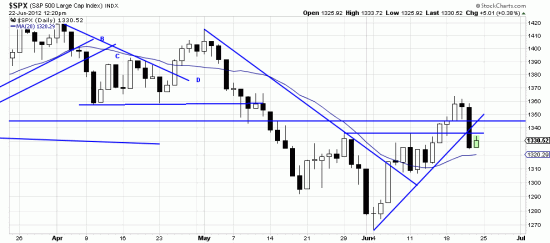

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=3&dy=0&id=p88572661534&a=214966864

Keynes — that iconic economist who is more insulted than honored — aptly said that investing was oftimes a game of musical chairs in which the winner was able to get to a chair before the others. Yesterday was one of those games –either gotcha or musical chairs. We are partially hedging some index positions. This is because of our theory of hair trigger stops and power bars. Radical moves in the market are often the explosion that set off the avalanche.

That doesn’t mean that our analysis of the market has changed. We still think this wave is headed higher. But readers should be acutely aware that in the present markets the musical chair players rule. This means that analysis and educated opinion and even market wisdom are of little use in the short term. As Oscar Wilde said, “Well, there’s little comfort in the wise this side of paradise.”

But this is often true in the short run. In the long run of course we’re all dead. Not one talking head or Friedman economist has managed to disprove Keynes on that point. In the mid run if readers stick to the Basing Point stops they will grind down those musical chair gamesmen in the long run.