In general the only reading we recommend is the chart, and it doesn’t take a lot of verbiage to analyze it. Also brevity is the soul of wit. We’ll be brief here. We reshorted gold and silver. That trade is what we call a no-signal trade. It’s just based on our analysis of the market and the possible ending of the upwave — which would be a B or beta wave. In connection with that we have some links to some reading which is not required, but might be of interest:

The link is to zerohedge.com an interesting site which we check out occasionally. It links to studies showing how blatantly Wall Street rips off investors. The text is also from zerohedge. And bears on goings on in the gold market.

Submitted by Mark McHugh from Across The Street

Jamie Dimon Has Issues

When just one firm accounts for 99.3% of the physical gold sales at the COMEX in the last three months it’s not what most of us on this side of the rainbow would consider “broad-based” selling. Of course discovering this kind of relevant information requires an internet connection, 2nd grade math and reading skills, and the desire to do a teeny-weeny bit of reporting. Sadly they’ve wandered so far down the rabbit hole that the concept of “physical demand” (i.e. people actually wanting to take possession of the stuff) is puzzling to them because the vast majority of the world’s so-called “gold-trading” takes place in the realm of make believe (which is their natural habitat). It’s all fun and games until somebody loses their metal and “somebody” has lost one hell of a lot of metal in the last 90 days.

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=5&dy=0&id=p95239461628&a=255869372

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=5&dy=0&id=p95239461628&a=255869372

Louise Yamada is a widely respected analyst. Here is a link to her thoughtful analysis of the metals markets:

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p88150915824&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p88150915824&a=214966864

George Soros recently gave a speech in Germany which is notable for it wisdom on the problems of the euro and the European Union. It is an analysis with which we absolutely agree. Here is the link:

http://www.georgesoros.com/articles-essays/entry/how_to/

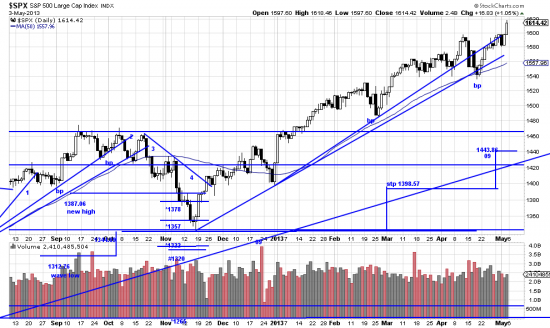

Meanwhile the market did pretty much what we expected — went to new record high closes. The market is not really climbing a wall of worry. It is climbing a mountain of denial and disbelief. The lowest trendline on the chart is the march 09 line. Just eyeballing it you can see how far prices are away.

Remember. No matter what you read or think the ultimate reality is the chart right now. The chart right now says stay long the market. The metals chart is not as definitive. Skillful practice says that a short is justified, especially since the risk is so clear — 1 or 2 percent over the near high. If the government and JP Morgan are selling gold we don’t want to stand in front of that train.