http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p20049953156&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p20049953156&a=214966864

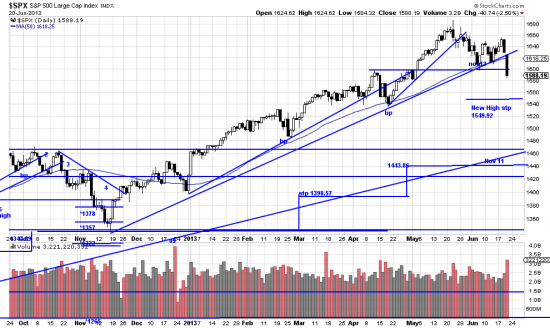

8 days of triple digit moves in the Dow ought to be enough to catch the interest of almost anyone — and enough to inspire teutonic schadenfreude in those who have been sitting on the sidelines eating their hearts out because they have missed one of the great bull markets of all time. But for all the drama — especially today where we saw a 40 point move in the SPX — prices are only down 5% from the top. And most importantly prices are a steep 5% above the next most important trendline, that of Nov 11. The all important Mar 09 trendline is so far away that it doesn’t even show on this chart. No bear market will develop without the breaking of these trendlines. Few things can be guaranteed in life. This is guaranteed.

And. Prudence dictates that we look to our stops in turbulent times. Illustrated here is the New High stop at 1549.92. The wave low stop remains where it has been for some time 1443.86, seen in the stair steps.

http://stockcharts.com/h-sc/ui?s=$SPX&p=W&yr=4&mn=6&dy=0&id=p30028146067&a=239474174

http://stockcharts.com/h-sc/ui?s=$SPX&p=W&yr=4&mn=6&dy=0&id=p30028146067&a=239474174

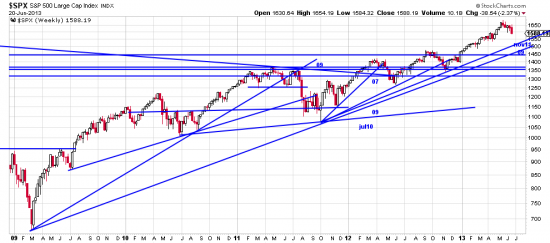

In the long term chart the placement of the Mar 09 and Nov 11 trendlines can be seen more clearly. We can also see that there is no sign of a major top formation.

Looking at the week — we remarked earlier that as Kipling said, those who keep their heads when all about them are losing therirs… We would add to that, when all about you are losing their heads, become a collector of heads. This opportunity is near at hand. We added on to our short silver, gold and bond positions which gapped down today. Also, (please don’t do this at home) we hedged some of our SPX position. We do this because we enjoy losing money on our hedges. Readers who turn their attention to Wimbledon and look on this volatility as the province of HFT traders and nervous newbies will be better served than participating in this naked mud wrestling. (Not even with naked co-eds but with smelly traders.)

This volatility should be looked on as professional (or unprofessional) panic.