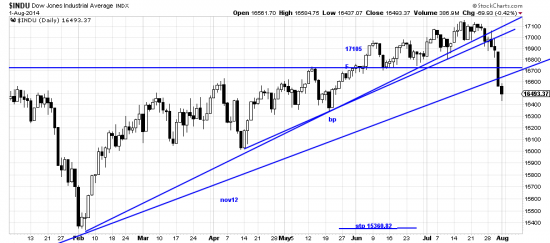

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=0&mn=7&dy=0&id=p23340123349&a=298224028

Thursday’s air pocket tore a short term hole in the trend and blasted through several trendlines. The trendlines from Feb and Apr would certainly foretell further damage. Worse, the nov12 line is penetrated. The Feb and Apr damage should be transient, especially in the market we have been experiencing for months. A confirmation of the nov12 break would argue for more severe downside. We should get an idea of this next week. Confirmation is always necessary — meaning a strong continuation of the phenomenon.

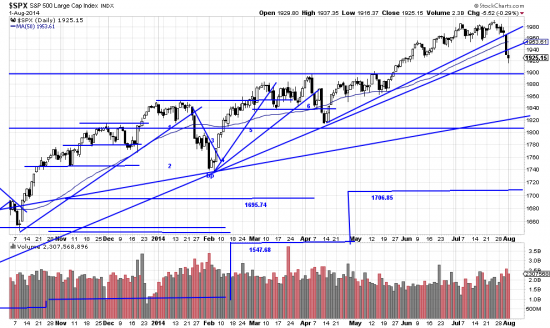

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p45772659374&a=266398464

The charts for the major indices are a little different. INDU looks worse but the same forces are operating on the SPX. Obviously this downwave will be a buying opportunity at some point. That point is in the zeta wave. Until then buying risks catching the falling knife. We pared back our UPRO positions and hedged with SPXU (the reverse ETF). We may do some more hedging next week depending on events.

But up to now we see no evidence that the bull trend is exhausted. The present downwave is a necessary movement in the market. Investors who just joined up need to be punished for bad timing and the uncertain need to be made to hesitate.