http://stockcharts.com/h-sc/ui?s=%24INDU&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=575819961

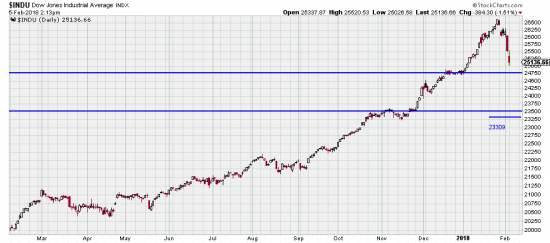

is what happens when you do the most amateur thing in the world and allow easy profits (large) to obscure a break in the market — also embarrassing when you get your time frames mixed up and maintain the consciousness of a long term investor when a clear trading situation is at hand. Well, as Tommy Armour is said to have remarked when his ball was in bad rough, “I put it there I’ll have to get it out”. Our ball has been considerably set back by a V top in the market. But let us say that we maintain our identities as long term investors then we look at the chart above and maintain our positions with a crow eating grin. By this system we are not required to do anything until the market price hits 23309 (basis INDU). Ah, less embrrassing, but crow still leaves a bad taste in the mouth.

We saw the crow bolt the coop (and will show you the getaway shortly) and said Ah nothing to us, we’re long term investors. Later when picking feathers from our teeth our self said to us “should have listened to your instincts.”

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=0&id=p70142979615&a=266398464

Here is a crystal clearl picture of the crow escaping the coop: A trendline is broken on a significant gap, screaming top! top! top! Sell me. Sell me.

Too bothersome we said. We’re long term investors. (But with a long history of tactical trading…)

Well ni modo as the Mexicans (not the ones who are going to pay for the wall…) say we put the bll in the rough. We have to get it out. What that involves is gathering cash reserves and going back in when we see the proper set up.

Take careful note of a reality here. Before the market takes off on the next wave up it has to wipe out or punish the present holders –especially those who just got on board. A market truism.

We expect a clear signal as to when to re-enter –Readers can deal with the situation by waiting it out, lightening up or hedging. We have done some of all of these. You are perfectly justified in sitting until the market takes out the long term stop and you certainly should be gathering cash for the next round.