http://stockcharts.com/h-sc/ui?s=CODI&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=207232007

http://stockcharts.com/h-sc/ui?s=FTR&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=207230758

http://stockcharts.com/h-sc/ui?s=BWP&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=207230755

http://stockcharts.com/h-sc/ui?s=PGH&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=207230764

Here is our attitude about “risky” high yielding dividend stocks. Ordinarily buyers of yield are chary of high yielding issues because they are “high risk”. Last time we looked it seemed like everything was high risk. But let us look at the way that edwards-magee handles risk. We measure it, analyze it and set a stop. As opposed to 90% of market participants. (And 100% of mutual fund managers.)

And we know that every investment involves risk and so we go into the transaction willing to risk x dollars before we call off the experiment.

With this attitude it is easy for us to buy issues which other investors might shy away from. We only look at the charts, but our readers might want to go to fundamental sources (or their brokers) to evaluate the issues we discuss here. Everyone knows what we think about fundamental analysis (not much the way most people do it).

Dividend reaping may be a productive strategy over the foreseeable future. So we have looked at a group of dividend issues. By and large their charts are dull. DULL. Halleluyah!! Most investors at this point would settle for dull. It’s better than naked terror since April.

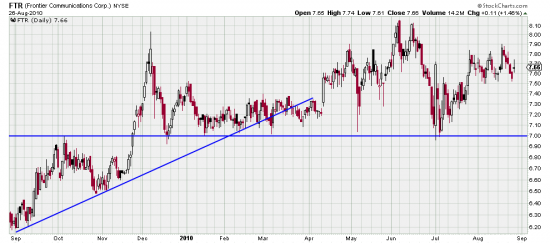

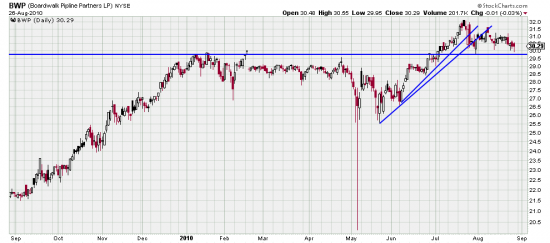

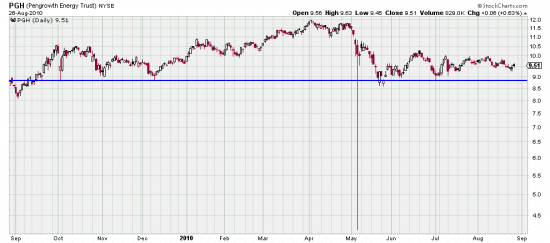

Here is the group we looked at and their yeilds:

BWP 6.69, CODI 9.65, CPNO 8.59, FTR 9.87, GEL 7.37, MLPI 5.74, MO 6.14, NGLS 8.25, NLY 15.67, PGH 9.18, PICO 8.72, EEP 7.48, LINE 8.87, VZ 6.45

Don’t just blindly buy these. Look at the charts. Following the line of reasoning we expressed above we think most of these are buyable. Use your best judgment. If you buy them find the horizontal line and set a stop about 2% under the line. Email us if you are in panic or in extreme confusion.

Is it obvious that you should diversify your capital if you do this? Hopefully. Spread your capital around among these issues. Don’t sink it all into NLY (no chart) though that is tempting. In fact we wouldn’t buy NLY until its recent downgap is filled.

You can see these charts at stockcharts.com.