http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=214966864

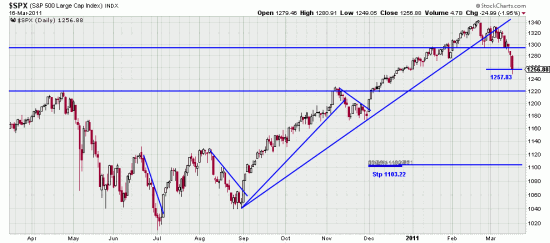

The Variant 2 stops in the S&P (1257.83) were violated today. Over the past several weeks we have informed readers of the the various stop options, Variant 2 being the stop calculated from the top, a tighter stop than a wave low stop. While we never recommend a course of action — as to whether readers should use a higher or lower stop — we do strongly recommend that if a reader has previously planned to use the V2 stop that he take that action. In the immediately previous downwave the V2 stop saved the paper loss of much capital. Most importantly to change your plan under pressure ultimately results in the destruction of morale and confidence. We never regret taking a stop. Re-entry is always possible, but if you lose all your capital the game is over.

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=2&mn=3&dy=0&id=p21251836326&a=227822935

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=2&mn=3&dy=0&id=p21251836326&a=227822935

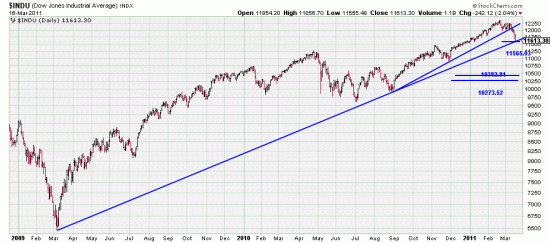

In the Dow prices are tiptoeing on the stop (11565.03), but closed above it today. This stop has special power as it coincides with the long term trendline from March 09. While the market has suffered a serious blow here and will continue to suffer for awhile we expect a rapid recovery and we also expect to see investors use this Japanese tragedy as an opportunity to get into the market. We certainly intend to.

Obviously timing of new investments must wait for the resumption of the uptrend.

There is the gambler’s alternative — that is when prices reach the ridiculous you start buying lottery tickets.