If a 190 point day doesn’t make short queasy nothing will. Let us specify how we feel about shorting. We love it. But, dear readers and students, shorting a roaring bull market is foolish in the extreme. Fighting the trend is for gamblers, not traders. Sometimes you make a quick hit. Most of the time you get hit. Don’t do it. Wednesday and Thursday were buy signals in the Dow, and stocks in general. In the Dow the old high was penetrated. Balance that against the SPX not yet having penetrated. But after the baying of the pundits (market overbought, market going to tank, market to market to market a fat pig…) seeing the market administer a lesson in black and white, confirming what we have been saying, was refreshing.

If a 190 point day doesn’t make short queasy nothing will. Let us specify how we feel about shorting. We love it. But, dear readers and students, shorting a roaring bull market is foolish in the extreme. Fighting the trend is for gamblers, not traders. Sometimes you make a quick hit. Most of the time you get hit. Don’t do it. Wednesday and Thursday were buy signals in the Dow, and stocks in general. In the Dow the old high was penetrated. Balance that against the SPX not yet having penetrated. But after the baying of the pundits (market overbought, market going to tank, market to market to market a fat pig…) seeing the market administer a lesson in black and white, confirming what we have been saying, was refreshing.

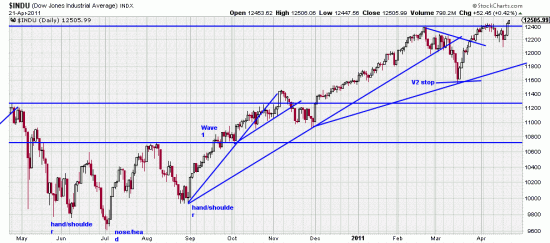

The market probably is overbought. It probably is vulnerable. Don’t worry about that stuff. The market just told you that it flushed some improvident people out, and, if this little formation is in fact a Kilroy (reversed H&S) continuation then there ought to be 726 Dow points in it, added to the 12391 high. Remember we do not stand behind forecasts and predictions. This is just a little technician’s noodling.

More noodling: Issues tend to develop habits. The Dow showed us a Kilroy bottom June to August last year. That makes the likelihood that the present pattern is also a Kilroy much more likely. Another thing to remember is that this market is rife with false signals. What hap;pens after the signal is all important.

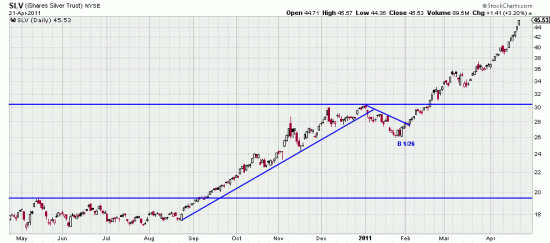

Gentlemen, you are watching the silver market go parabolic. We will discuss several ways to handle it. You can, if playing this for the long term stick with your Basing Point wavelow stops which we have described recently. You can use a variant of Variant 2 Basing Points. Take the low of the most recent high as a Basing Point and use a big filter –7 or 8%, resetting that Basing Point each time a new high exceeds the old Basing Point by 3%. If you’re trading it you could put a new stop under each day’s low, (1%) ratcheting up after each higher day. Set hourly Basing Points with tight filters. But start by realizing that only idiot savants, drunks, and certified lunatics (there’s a thought: use the moon) will catch the top.

Gentlemen, you are watching the silver market go parabolic. We will discuss several ways to handle it. You can, if playing this for the long term stick with your Basing Point wavelow stops which we have described recently. You can use a variant of Variant 2 Basing Points. Take the low of the most recent high as a Basing Point and use a big filter –7 or 8%, resetting that Basing Point each time a new high exceeds the old Basing Point by 3%. If you’re trading it you could put a new stop under each day’s low, (1%) ratcheting up after each higher day. Set hourly Basing Points with tight filters. But start by realizing that only idiot savants, drunks, and certified lunatics (there’s a thought: use the moon) will catch the top.

But don’t worry. We’ll be out there rolling those bones with you, and if we see it you’ll be the first to hear.