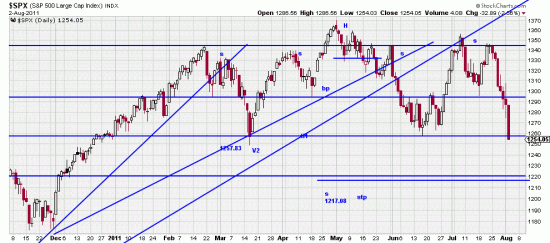

Today on an impressive (if not depressive) power bar down SPX prices penetrated the neckline of what appears a head-and-shoulders formation. In our last letter we explored the possible implications of completion of this formation, detailing various targets for a downwave. We calculated the targets using a bevy of technical analysis techniques and now is a good time to remind readers that the targets are an analysis, not a guarantee or a prediction.

However it also necessary to emphasize what we have been saying for months, that hedging and scaling out are the order of the day.

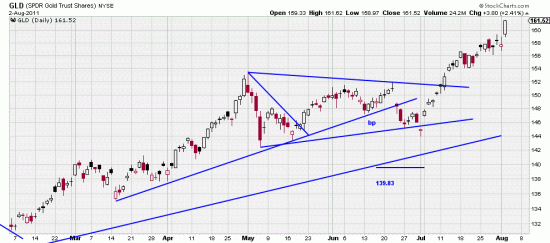

If you were listening to our previous letters you may be long gold and the Swiss franc. This would be good.

Gold broke out a triangle encouraged by feckless (and criminal) politicians. Surprisingly it has some characteristics of a flag (the July 20 activity). Sometimes this would mean the end of the move, but today’s powerbar is another buy signal. This wave has run for awhile, so if trading high alertness is in order.

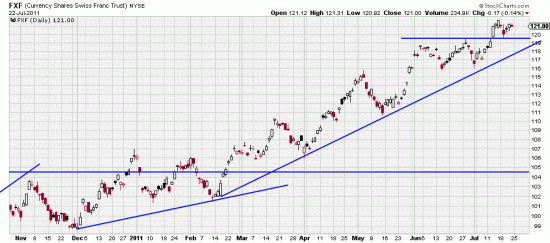

The reading and analysis of the Swiss franc has been very successful.

Shown when we pointed it out. And shown at present:

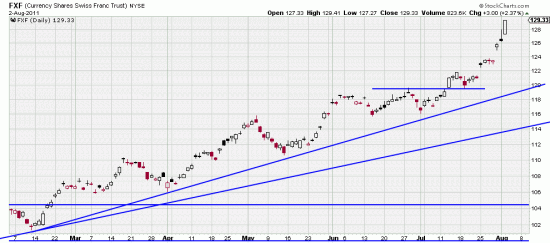

Shown when we pointed it out. And shown at present:

An interesting chart. It almost looks like a flag without a flagpole. Whatever, it is in the process of going parabolic so only highly skilled and nimble traders should take any Swiss trains at present. If long you probably want to raise your stop up to 2 or 3% under the low of the high day.

An interesting chart. It almost looks like a flag without a flagpole. Whatever, it is in the process of going parabolic so only highly skilled and nimble traders should take any Swiss trains at present. If long you probably want to raise your stop up to 2 or 3% under the low of the high day.