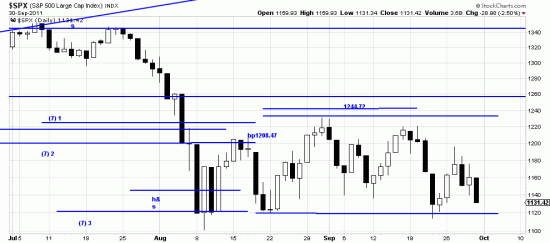

Friday was but the continuation of a downwave which started Tuesday by our method (which counts the last day of a wave with the dying wave and counts the same day as the start of the new wave. We have read about every interpretation of this formation which could be thought of — including, if you would believe a mini-head-and-shoulders. The truth is it’s not anything — or at least not anything you can look up. A congestion zone, a wildly uncontrolled rectangle. There may be a hint of what is to come though. Starting in late August we have a pattern of lower highs and lower lows. Tuesday’s high is not yet a significant point, as we need 3 days away from it to give it significance. Notice the 3-days-away rule reappearing. A handy way to evaluate price behavior and determine whether it has validity or not.

Friday was but the continuation of a downwave which started Tuesday by our method (which counts the last day of a wave with the dying wave and counts the same day as the start of the new wave. We have read about every interpretation of this formation which could be thought of — including, if you would believe a mini-head-and-shoulders. The truth is it’s not anything — or at least not anything you can look up. A congestion zone, a wildly uncontrolled rectangle. There may be a hint of what is to come though. Starting in late August we have a pattern of lower highs and lower lows. Tuesday’s high is not yet a significant point, as we need 3 days away from it to give it significance. Notice the 3-days-away rule reappearing. A handy way to evaluate price behavior and determine whether it has validity or not.

As the present trend tends to continue — and the dominant trend is down, and the secondary trend is sideways and the minor trend is down, as just noted — long investments will continue in danger. As for emphasis we think the secondary trend — the violent sideways trend will trump any sort of rational strategy — long or short. The algorithmic systems we run — primarily Basing Points — are short, as are the chart analysis systems –primarily based on the March ’09 trendline.

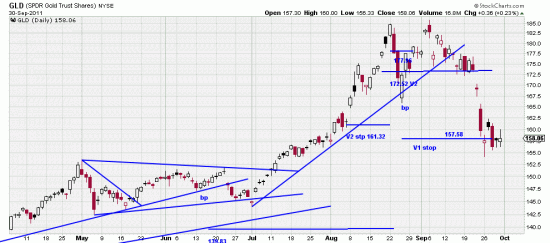

Gold has been slippery of late. Something vital has changed here. It started in August with the four day downdraft — or flush or wipeout — or what have you — continuing with the past 7 or 8 days. At first we looked at the plunge as a buying opportunity, like that of August where they turned the market on a dime after two days of dive bombing it for about $190 — 19 basis ETF.

Gold has been slippery of late. Something vital has changed here. It started in August with the four day downdraft — or flush or wipeout — or what have you — continuing with the past 7 or 8 days. At first we looked at the plunge as a buying opportunity, like that of August where they turned the market on a dime after two days of dive bombing it for about $190 — 19 basis ETF.

Now we are looking at this formation a little differently. This may be a flag forming. If it is then we could see another 15 down here to complete the flagpole. The risk on a short trade can be tightly controlled, setting the stop a percent or so above the high four days ago.

The bonds (here TLT) — like everything else in the world tantalize with signals like quarterbacks with head fakes. The pattern of gaps implied a top and trend change. The covering of the second gap could end a trade. But an entry looking for a true trend change would set the stop 2 or 3% over the last high. We keep saying that this is going to be the bonanza trade when it happens. Does anyone believe that money will be free forever?

The bonds (here TLT) — like everything else in the world tantalize with signals like quarterbacks with head fakes. The pattern of gaps implied a top and trend change. The covering of the second gap could end a trade. But an entry looking for a true trend change would set the stop 2 or 3% over the last high. We keep saying that this is going to be the bonanza trade when it happens. Does anyone believe that money will be free forever?

Meanwhile the euro and swiss franc continue in downtrends. Mature downtrends can be joined the same way porcupines make love — very carefully. And with money management stops — we will look at these again this week. Same for the dollar which continues to defy gravity, but it is not impossible that the worm has turned. And wouldn’t we all like to bet against Angela?

It is hard to imagine that the Europeans could mismanage their affairs more ineptly than the US, but the market is telling us they can. Not just in their treatment of the PIIGS, but in their attempt to smother their economies by clamping on the austerity instead of stimulating their economies. Does that sound familiar?

With politicians — theirs and ours — watching the wrong shell in the economic shell game we have a profound opportunity to experience what the Great Depression was like. Don’t blame us for sounding like J.M. Keynes. Paul Krugman, who has more economic prizes than we are ever likely to win said it first. Think about it. The house is burning down and they are quarreling about the mortgage.

On the bright side, she said, as the fire trucks screamed past, there is every possibility we might make a fortune on the short side in a real bear market.