Wall Street of course is a giant risk sharing, capital financing engine — the beating heart of capitalism. That is one of its purposes. Aside from that one of its major functions is to transfer investor money into Wall Street pockets: it was as we remember John Bogle who said:

“Our hypothetical fund investor has earned $1,170,000, donated $700,000 to the mutual fund industry, and kept the remainder of $470,000. The financial system has consumed 60% of the return, the fund investor has achieved but 40% of his earnings potential. Yet it was the investor who provided 100% of the initial capital; the industry provided none.”

Wednesday’s WSJ featured an opinion piece by Burton Malkiel in which he noted that investment managment fees were not worth a farthing, that index funds consitently outperformed 2/3 of active managers. While ripping off about $24B in fees currently. Malkiel is not our favorite analyst/economist. In A Random Walk Down Wall Street he was disrespectful of our master, Magee besides advancing the semi idiotic proposition that prices are random. Mandelbrot demolished that academic nostrum with his article in the Scientific American — “A multifractal walk down Wall Street.” We started to twit Malkiel in 2009 with a letter asking him how his philosophy and method was coming along, but never mailed the letter because we couldn’t find a stamp. Besides it is not our mission to enlighten the unwashed — our mission is to take their money.

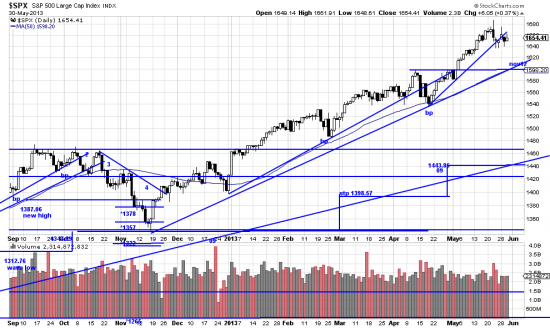

That has not been easy this week. See chart:

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p88150915824&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p88150915824&a=214966864

Here is a close up:

(Use link above)

A 26 day trendline is broken. This should be not a big deal — in fact it may just involve drifting sideways for a few days. But it must be noted. The biggest bear markets begin with the breaking of a short term trendline. It has in addition broken the mood of the market, where Japan stocks were running wild, the yen was plunging and the euro was sliding. We remarked in our last letter that EWJ might be a clever buy.

http://stockcharts.com/h-sc/ui?s=EWJ&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=227075581

http://stockcharts.com/h-sc/ui?s=EWJ&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=227075581

But today the Nikkei ws down 5% so we don’t think it’s a good idea anymore. Too clever by half. As were our shorts in the yen and the euro which we closed with little damage.

It is now watch and wait time as we see what the effects of the trendline break are.