Between those who are predicting (with 98% reliability) a serious crash almost upon us, and those who see gold raining from the clouds (the Cloud?) we find ourselves bewitched bothered and bewildered. And often extremely annoyed. Mostly at ourselves for being sucked into someone’s promo machine with !!!tdadum!! the secret calendar and the !!tadum!!! 100% reliable crash indicator. We get a paragraph into these examples of 100% Bull Sh*t and start kicking ourselves — fooled by Lucy with the football again. Ah, the sacrifices we make for our art and our readers…

Prediction is a fool’s errand. There is only one way to make money in the market: Do what the market is telling you to do right now.

Nevertheless let’s do a little predicting…

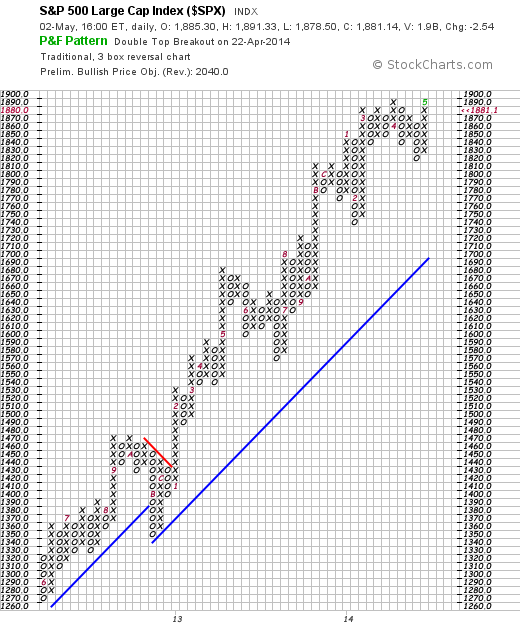

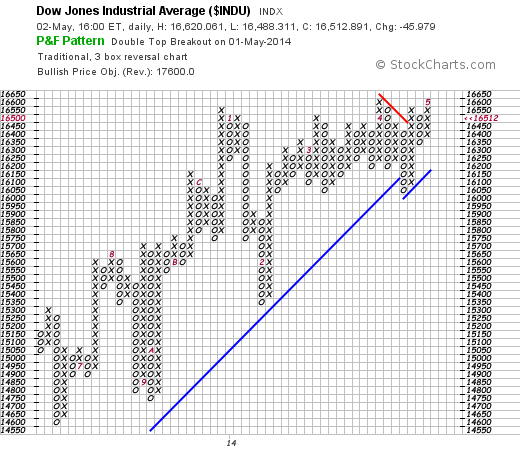

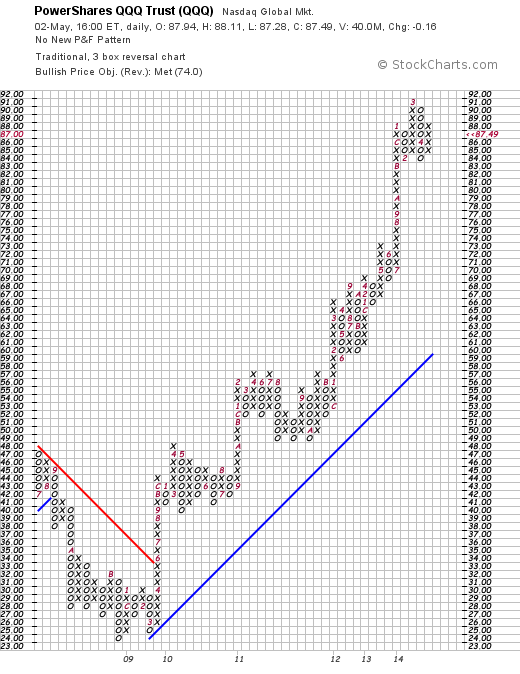

With the understanding that we’re joking, and that predicting is one thing, and using the tools in the technician’s toolbox is another. With that in mind what does the PnF method have to say about the market?

The PnF method thinks that the SPX has a target of 2040.

The PnF method thinks the INDU has a target of 17600.

The method thinks that the Qs have met their bullish objective of 74, and overrun it to 87.

What do we think? Well, we think all of these are going to occur. We shook the crystal ball and discovered — damn — it was a snow globe with penguins inside it…. but the penguins were sending us a message: watch out for penguins bearing predictions. You will remember that the PnF method ignores time and the inevitable up and down waves that occur on the way to the target. So who knows when these targets will be hit. We don’t. AND most importantly neither does anyone else. Not Goldman, not De Mark, not Buffet, not Gartman, not NOBODY. But the chart knows when a top is happening: (Do not divulge this secret to the unwashed and undeserving.) Trend lines get broken and top patterns happen.

We have said recently that the market — in the indices and in numerous issues — is in a sidewave. In a sidewave good practice dictates that nothing is done (except for scalping and day trading — heaven forfend that any of our readers are doing that — unless they are making money in which case good on’em). Longer term (and prudent) investors are waiting for the resolution. In the trade we call it patience.

And it will out in the end.