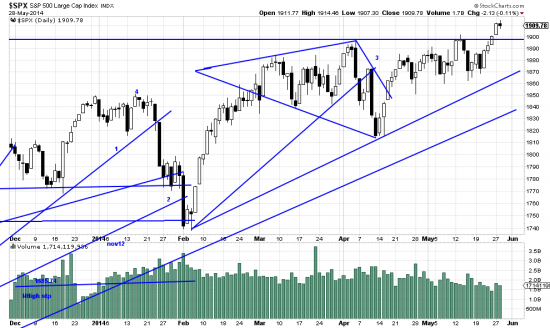

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p83257770514&a=266398464

If the above chart is to be believed the stalemate is broken. Exactly what happens now is in the hands of the market, but contrarians should at least be chastened. But since they always bet on a reversion to the mean they will be selling. This may be a profitable activity for a day or so, but this breakout is bettable and the uptrend appears to have resumed. Well, we’re betting on it anyway. We added on to our SPX position, and put our Qs position back on. A lot of issues appear to be buyable now: IBB (the biotechs), FPX (the IPO ETF (not our favorite)), PNQI, and JJC (copper).

We wouldn’t plunge on any of these — risk no more that 5%. While SPX surged gold tanked. We put on the first unit of a short position, and are already short the miners (DUST).

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=9&dy=0&id=p79177025382&a=255869372

The signal in gold is quite good. Readers may remember a letter we wrote sometime back which computed a price target of 880 using the rule of seven. The PnF chart is at odds with this analysis, still predicting a bullish target, but we don’t determine our analysis using PnF. The signal is very clear here. Lacking Putin eating more of Ukraine or warfare breaking out in Washington between the conservatives and the liberals (as opposed to the conservatives vs the tea party ) gold should slide. Don’t get us wrong. We love gold. (We still mourn that bag of krugerands we frittered away back in the 80s.) Well, as they say in Alsace, machts nicht, or, gnu?